Why banking businesses need CRM

With so many choices in an ever-evolving market, customers can literally pick-and-choose where they’ll receive their advice, invest their money, take out their loans, and purchase financial products. In order to be ahead in this choice, your financial institution needs to have brand authority in the market that shows the customer that yours is the organization to choose.

A CRM that is specifically tailored for the financial industry can deliver the following benefits that will help you develop brand authority and a marketing strategy to land the most customers:

- Organize your clients’ information into easy-to-digest dashboards

- Integrate with social media to enable banks to own and manage their online profile

- Dynamically determine your clients’ needs and discover new ways to fulfill them

- Determine new leads and market to them

- Flawlessly integrate with other banking systems

- Monitor security risks

Make your client data work harder

Utilizing a CRM in the banking industry can help you to keep your clients’ information and analysis stored in digestible and accessible dashboards. This is highly important as referenced in this article from The Journal of Internet Banking and Commerce.

Using a financial CRM like Salesforce Financial Services Cloud makes it possible to track their individual financial needs, investments, loans, and earnings on a large scale and consolidate this so that both you as the financial institution and the client can access this from any location or device in an easily understood tailored format.

Just like your clients, their financial requirements will be constantly evolving and changing. Utilizing a CRM specifically designed for the financial industry, will help you to be aware of changes in your client profiles and can highlight large changes that require attention on your part.

Forbes.com discusses how customer service improves when a bank uses CRM technology, primarily because of the accessibility of information and the ways in which it can be organized.

Use automation to generate new leads and turn them into profitable clients

A strong CRM will constantly monitor your financial institution’s needs and be on the lookout for trends in clients that will help you market to them. It can also monitor social media streams and automate acquisition campaigns and help you to create content that will appeal to as many clients as possible.

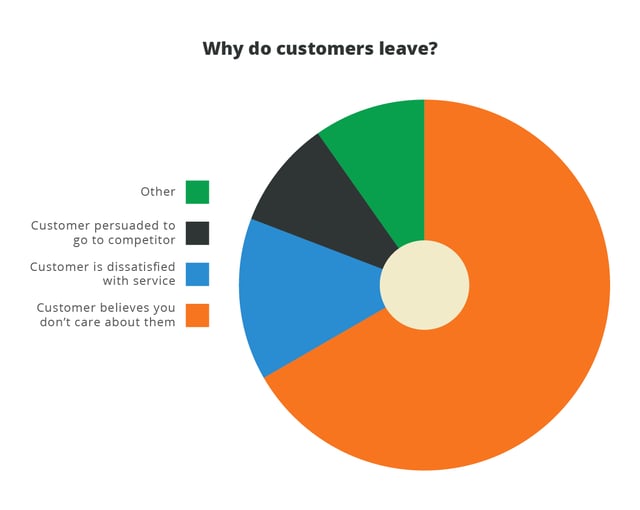

Furthermore, you are more likely to keep customers if you can deliver a quality product that doesn’t create problems for them. In a study from CustomerThink, it was found that 68% of customers leave their service provider because of service problems, so ensure that you use the right CRM to retain customer loyalty.

Integrating customer data onto a single platform helps you to understand your customer journey more fully - Financial Services Cloud by Salesforce can help identify and capitalise on opportunities for cross-selling, and create personalised offerings of products and services for each individual.

Maximize integration and security

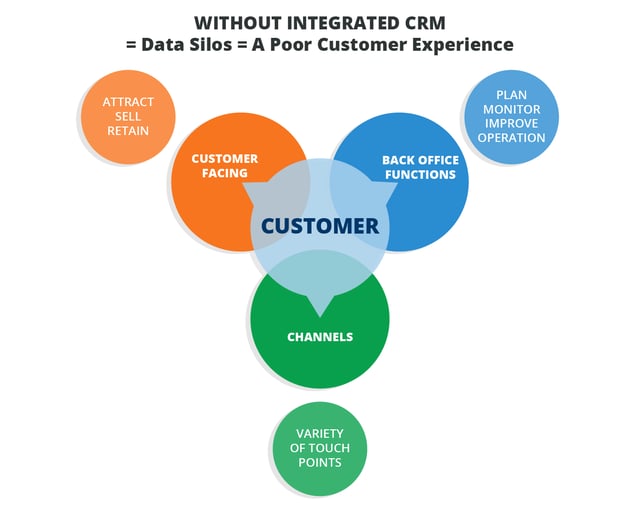

Without an integrated CRM, customer experience becomes a disjointed affair.

An ideal CRM system needs to seamlessly integrate with other banking systems and financial institutions so you can access all of your clients’ financial information with ease and avoid data silos. This means that cross-departmental staff will be able to have a full client profile without your client having to go through any frustration.

Additionally, a strong CRM option for the banking industry has to include safety protocols and protections to keep your clients’ information safe and secure. Salesforce has structures in place to safeguard client information and monitor for anything that seems to be out of the ordinary.

The most of your banking industry CRM

When managing other people’s finances, it is not enough to just be highly organized and prepared. A CRM that is specifically engineered for the financial industry will help your business to be ahead of the rest through personalized 1:1 financial relationships, individualized dashboards, intelligent integration and automation, and security protection.

Need help with deciding which CRM is right for your financial institution? Contact our consultants and we will work with you to devise the perfect integration strategy, approach, and plan that will work with your budget and current infrastructure.

Leave a Comment