Insurance sector competition makes CRM for insurance companies a necessity

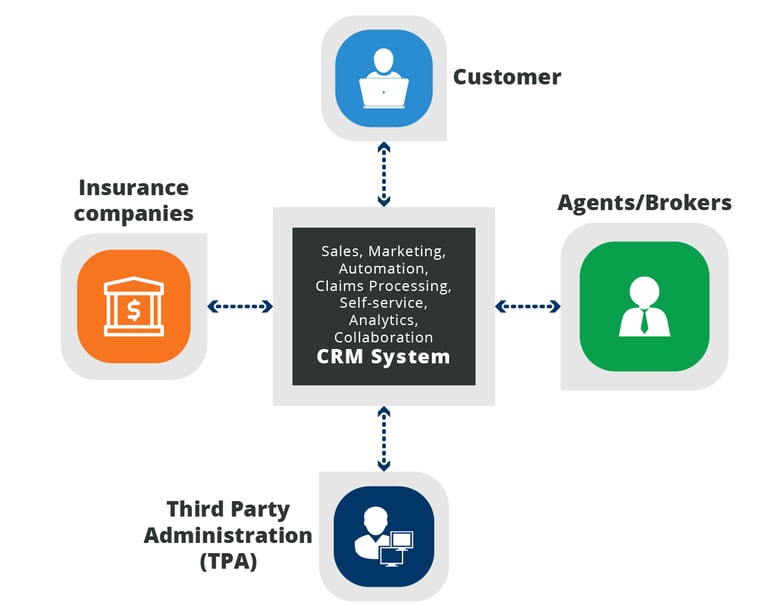

Customer relationship management (CRM) encompasses the strategies, methods and tools used to evaluate customer behavior and interactions to cultivate positive customer relationships. CRM is an essential tool for growing satisfaction that leads to repeat business and long-term customer loyalty.

Successfully implementing a CRM system is practically a necessity within the highly competitive insurance sector where a focus on technology helps even smaller firms.

CRM personalization inspires positive customer experience

Insurance is a very specialized product that relies on close customer interactions. CRM is an excellent method for increasing understanding on potential and existing customers, and thereby enabling agents to provide unique services according to their individual situation.

By starting this journey at the prospect stage, using CRM, insurance agents can have a better picture of the customer’s requirements before they even contact them.

CRM systems, like Salesforce Financial Services Cloud, provide the ability for marketing automation not only enabling insurance brokers to nurture leads into customers more efficiently but also to contact customers at the right time with the right advice or insurance product.

A CRM process involves recording, analyzing, and interpreting data about preferences and behaviors, throughout the customer journey and starting even before the first purchase is made. Exceed expectations by delivering more personalised experiences for policyholders using Salesforce CRM Solution for Insurance.

This understanding is essential for boosting sales by ensuring that packages are suitable and offer the best cover for every customer.

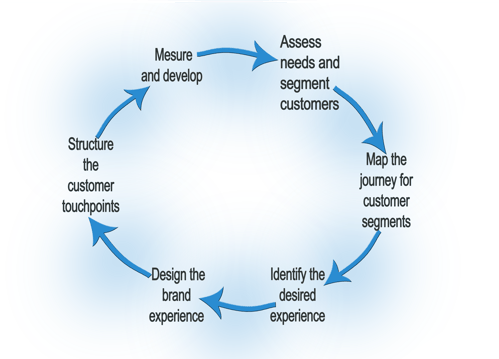

The Cycle Of Assessment Improving Customer Brand Experience

Successful CRM is based on assessing and analyzing customer behavior with iteration along the way, this results in positive customer experience and responses that lead to repeat purchase and loyalty.

CRM gives insurers the opportunity to leverage superior customer service

In the increasingly competitive world of insurance, companies are looking for new ways to differentiate themselves from competitors to retain customers.

One key way for insurance companies to maintain and improve customer loyalty is to offer superior customer service, whether this is related to sales or claims underpinned by CRM. Not only does this encourage repeat purchase by pre-existing customers, reducing customer churn and increasing lifetime value, but it also helps in acquiring new customers by improving word of mouth and prospect experience. Prioritize inquiries based on urgency and ensure your clients needs are met by having the right person on the case. And do it all on the Salesforce platform.

Insurance companies without CRM lack the insight required for crafting personalized sales, claims and service interactions for large numbers of clients that CRM software can provide.

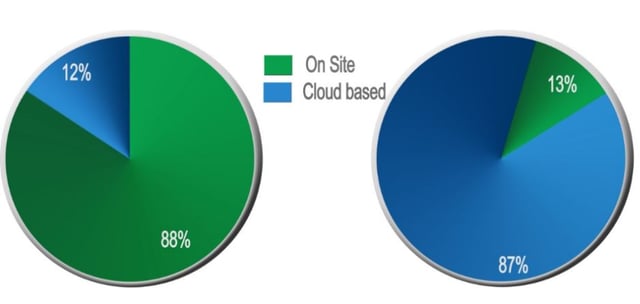

Cloud-based CRM increases mobility, can be integrated with websites and linked to marketing, sales and support documents. The result is that staff and clients can connect regardless of their location, maximizing responsiveness and creating a more integrated service environment.

In 2008, only 12% of companies used cloud-based CRM solutions. This figure had moved up to 87% by 2014.

CRM enables insurers to secure repeat business

CRM integrates multiple facets of a business; it presents a cost-effective method for connecting people and breaking down data silos, giving a single customer view. This provides insurance teams with the ability to cross and up-sell more efficiently creating repeat sales to existing customers by keeping the needs of each at the center of marketing, sales and support communications.

Overall

Supporting personalized and efficient customer service and sales, a CRM system gives insurance companies the opportunity to support customers throughout their lifetime, extending their journey with the company instead of simply providing services in the moment.

Need help with deciding which CRM is right for your financial institution? Contact our consultants and we will work with you to devise the perfect integration strategy, approach, and plan that will work with your budget and current infrastructure.

Leave a Comment