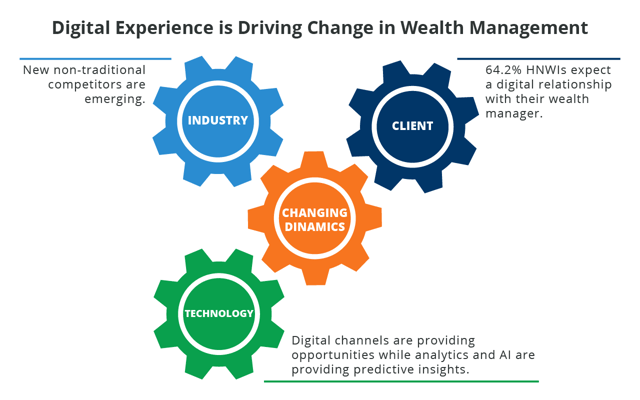

Digital disruption offers opportunity as well as threats

In an era of digital disruption, the financial services industry has been transformed. A study involving more than 50 wealth management firms, revealed that the wave of digital revolution, with startups and digital models of doing business revolutionizing the industry, has left traditional wealth management firms at a crossroads.

On the one hand, they can continue as they have done and potentially lose out to steep competition from new agile online market players or they can embrace technology and combine this with their more traditional personal approach, providing them with a synergy to drive extensive opportunities for growth. CRM for financial services is one way of combining technology with the ability to personalize client interactions on a large scale for wealth managers.

CRM improves competitiveness for investment advisors serving retail customers in a number of ways:

High Net Wealth Individuals expect digital channels

CRM integration provides convenient channels for customers to access self-service solutions, advice as well as to partner with their wealth manager.

Personal consultation is one of the traditional tenants of financial services provision. Technology has however greatly changed the way in which customers expect this to be done.

Alongside the possibilities offered by the availability of CRM systems reinvented for financial services, affluent individuals, who most likely to be investors, have become well accustomed with digital channels. According to one study 65.4% expressed that they would leave a wealth management firm if integrated channel experiences are not provided to them.

Salesforce Financial Services Cloud platform leverages the cloud, allowing all member of your business to easily collaborate across any channel or device. Information is collected, analyzed, and stored automatically, and can be accessed and updated in real time to give a complete picture of your clients and respond to their needs and requirements.

Understanding clients' financial goals

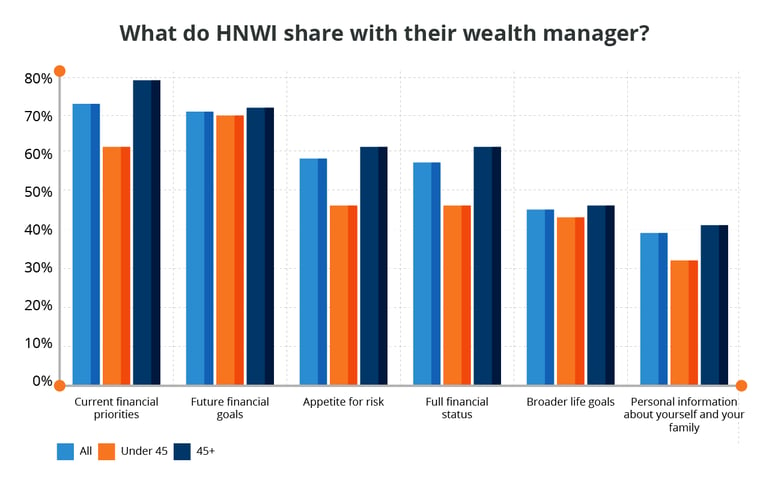

According to a study conducted in 2011, 25% of advisors acknowledged that they are not even familiar with their clients’ overall financial goals. CRM is helping in understanding the financial goals of investors on a large scale today as personal information has become more integrated into systems that provide anytime/anywhere access, marketing automation and the functionality to enable advisors to nurture prospects into clients and provide the right products and advice according to detailed client profiles built up over time.

In the future, it has been predicted that the trend in using personal data will only increase as two-thirds of high net worth individuals (HNWI) under 45 are positive about the use of personal data by apps or websites to tailor financial information, products or services to their needs.

With Salesforce CRM for Wealth Managers in place, advisors can track client goals and gain an understanding into what matters most to clients in order to drive more- tailored journeys and even stronger client relationships.

CRM provides a platform for collaboration between the client, wealth manager, and financial product provider

Wealth Management is an industry built on trust and more than half of HNWI worry about losing money or being taken advantage of. To earn investor trust, wealth managers want to provide reliable and robust advice. To achieve this, partnership and collaboration between specialists to provide superior client service is common.

With CRM for financial services platforms, the nature for financial service collaboration has become more dynamic.

The approach in investing has shifted from being self-directed or from solely relying upon the wealth manager to being more collaborative.

Forecast / Easy Analytics with Reports and Dashboards

Today’s financial CRM systems are pre-packed with reports which are presented through interactive interfaces known as dashboards. From here clients and wealth managers can analyze and visualize in detail the performance of the investments. CRM for financial services have the capability to update risk profiles of investors based on the adjustments in the investment mix.

Salesforce Financial Cloud surfaces actionable client data that scales as your business and client portfolio grows. It allows you to analyse and report on this data so you can gain insight into relevant client information.

The ability of today’s CRM for financial services technology to produce a 360 degree view of the entire client list, individual profiles and portfolio is enabling insights, prediction and proactive action that is giving traditional firms the agility they need to compete in the digital marketplace.

Need help with deciding which CRM is right for your financial institution? Contact our consultants and we will work with you to devise the perfect integration strategy, approach, and plan that will work with your budget and current infrastructure.

Leave a Comment