Customer retention in banks needn't be difficult

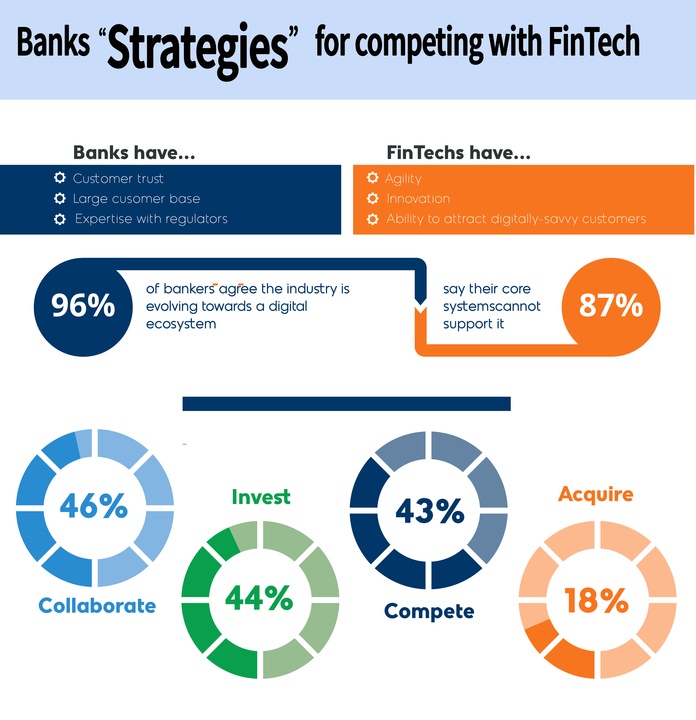

According to research , more than half of banking customers (58%) have dealt with more than two financial service providers in the last three years with many still using their existing bank while buying from others at the same time. Technological advances mean that every customer is now a digital customer; this digital disruption combined with customers who are actively looking at other service providers means traditional banks needing to get on board with technology or lose out to more innovative competitors.

With Salesforce Financial Services Cloud CRM for banks, customer retention needn't be hard work.

So why do customers use more than one bank?

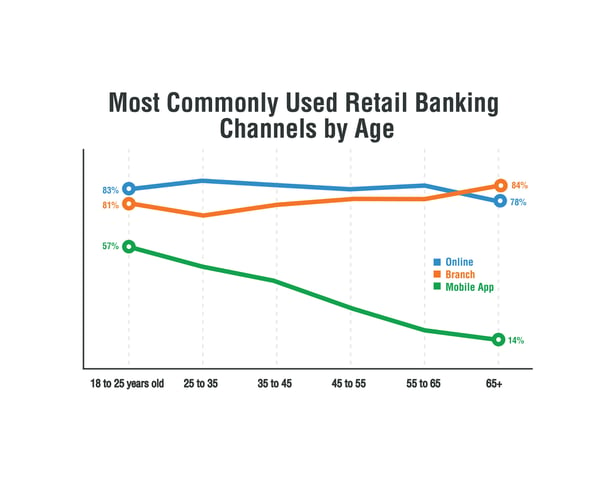

There are many reasons why customers switch bank providers or purchase financial products from multiple banks. These include poor customer service, availability of banking channels, fees, as well as lack of transparency. If traditional financial institutions are to stop losing existing customer sales to their digital competition they need to become a one-stop shop using technology centered around fulfilling all their customers' financial needs.

Why banks need Salesforce CRM for customer retention

Given this trend of customer fluidity, to retain customers and maximize their purchases across the full breadth of the banks financial product portfolio, banks are required to strengthen their customer relationships and improve operational efficiencies

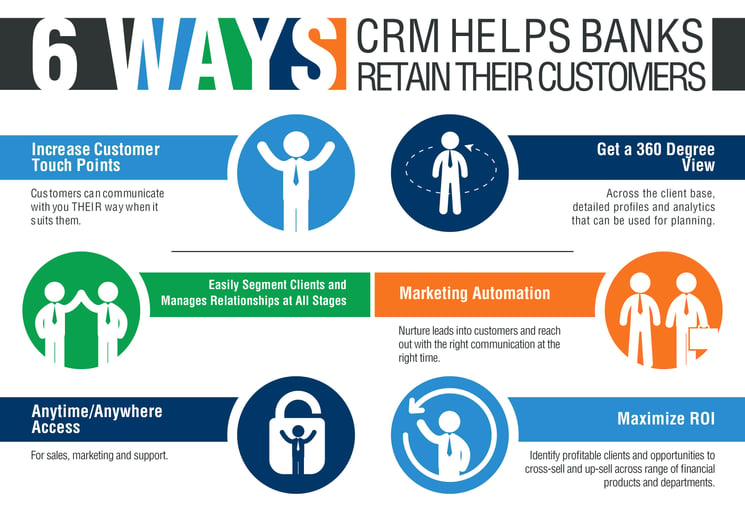

One way that banks can get to know their customers better and delight them by being able to anticipate and meet their needs faster and more economically is by implementing an effective, sector-specific customer relationship management (CRM) solution like Salesforce Financial Services Cloud.

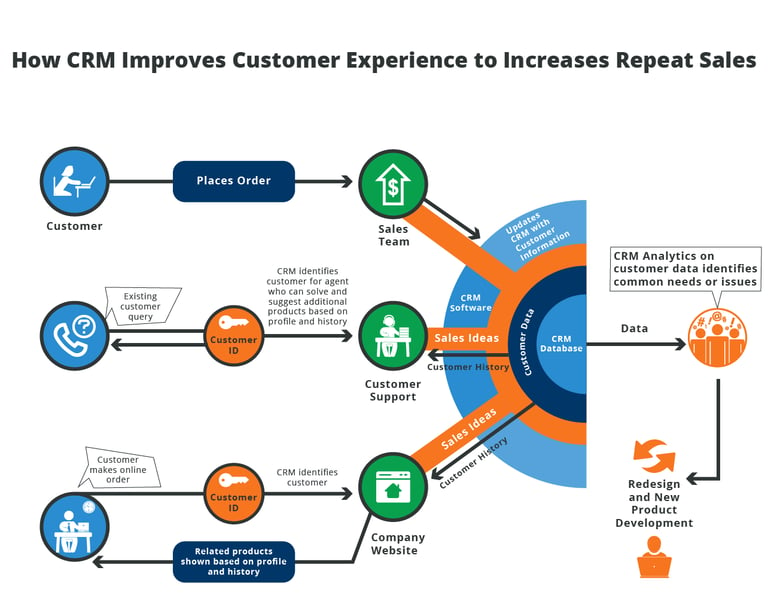

Designed to help financial businesses, including banks, to manage their various business processes, such as customer data, business information, customer interaction, and sales, Salesforce enables banks to gain a deeper insight into the profile of their customers as well as their spending habits and contact them at the right time with the right products and advice.

Salesforce Finance CRM

Through Salesforce banks can gain a holistic understanding of existing and even potential customers, which they then use to create opportunities to better serve them. Specifically, banks can use the gathered data to implement intelligent strategies to drive sales productivity and competitiveness.

Salesforce also includes digital tools that can be used by banks to empower customer support teams to solve problems faster. Banks can even create online communities with Salesforce Community Cloud that provide real-time answers to customer inquiries across all channels including mobile devices. This enables customers to solve their issues online either through self-serve or with an advisor, thus reducing the number of customers who are disgruntled by the long waiting time needed just to speak to a bank operator.

Salesforce also enables financial representatives to view CRM data in the cloud. This means that banks, their customers, and partners such as mortgage brokers can easily access customer and product data. They can then use that data seamlessly and without hassle to create optimal experiences for their customers, increasing repeat business, brand loyalty and retention.

Salesforce also provides banks with the ability to delve into customer career milestones, household relationships, preferred channels, and financial objectives. This way, banks can easily create personalized customer relationships and can be part of their customers journey in achieving their goals. Know and understand your key customers with clear insights into their financial goals. Help them reach new milestones and build a trusted relationship by helping them in the way they want and need - achievable using Salesforce CRM for Financial Institutions.

In today’s competitive banking industry, customers are now opting for financial service providers that not only could help them manage their money but also provide them with added value advice, digital tools and services to help them meet their life and lifestyle goals.

Banks are using Salesforce Financial Services Cloud solution to create customer-focused strategies to retain clients and maximize their profitability across their financial products and services.

Need help with deciding which CRM is right for your financial institution? Contact our consultants and we will work with you to devise the perfect integration strategy, approach, and plan that will work with your budget and current infrastructure.

Leave a Comment