Digital innovation is essential in insurance

The need to keep up with technology is evident within the insurance industry where, according to PwC’s 2017 CEO Survey, insurers have expressed the need to innovate in order to remain competitive. To this end, CRM systems deliver a number of benefits.

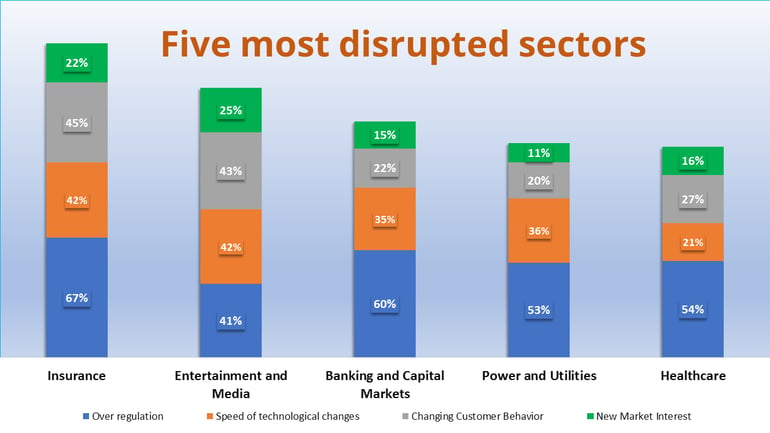

In the study, 54% of CEOs in the insurance industry indicated that technology has a significant impact on their competitiveness. Furthermore, 42% of insurance companies expressed concern with the speed of technological change and the impact that this will have on their business.

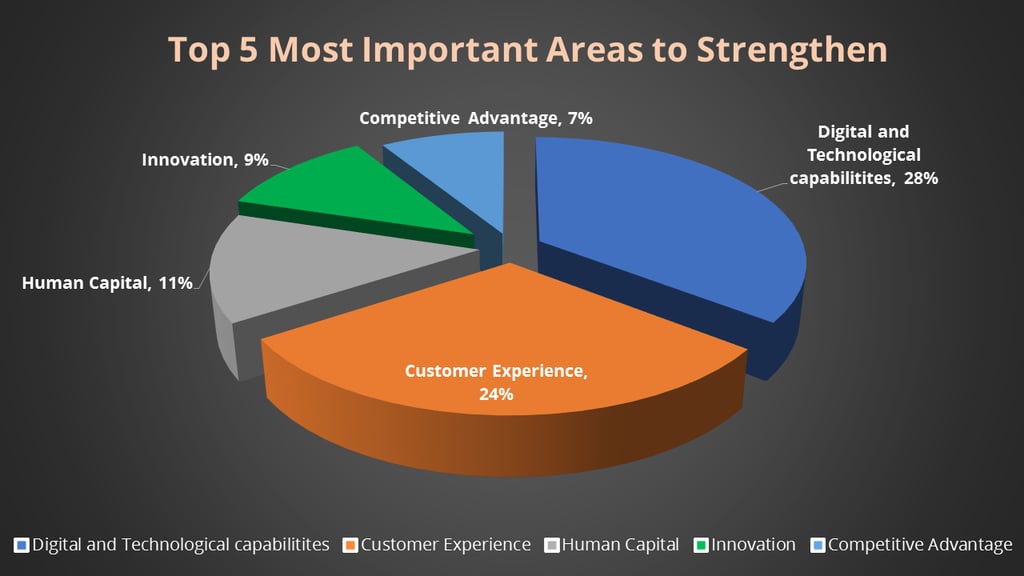

Of the top five areas to strengthen, CEOs identified digital and technological capabilities (28%) and improving customer experience (24%) as the two most important areas to focus on to achieve business growth. It is at the intersection of these two core areas that the fundamental importance of the implementation of a solid CRM finance solution for insurance brokers is evident.

Source: http://www.pwc.com/gx/en/ceo-survey/2017/industries/pwc-ceo-20th-survey-report-2017-insurance.pdf

CRM is a Platform for Improved Customer Experience and Faster Claims Resolution

Consumers have become well adapted to the convenience and the availability of communication channels like email, phone, chat, and social media that in effect have increased the expectations by policyholders in terms of customer service experience and prompt handling of claims.

In addition to this, as can be seen in the diagram below, 44% of insurance customers would switch if their preferred communication channels were not available during the claims process.

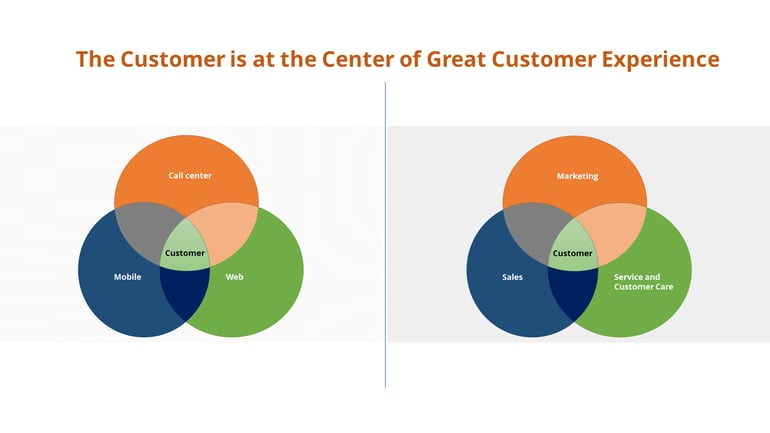

With one in two customers saying that they would not choose an insurance provider that did not provide communication across a number of channels, including digital, CRM for insurance provides the connectivity and access to customer information required for great customer experience and fast claim resolution. Gain a complete picture of interactions, requests, and opportunities using Salesforce CRM for Insurance.

CRM as a channel for insurance consultation services

A CRM system can be a channel for information dissemination and collaboration between policyholders and advisors. According to Accenture, 80% of policyholders would switch insurers to get more personalized service.

Developing a one to one relationship between the advisor and customer is therefore essential in the insurance industry. The right CRM system, which will enable brokers to develop and access a full picture of all of their clients, including their history and preferences in order to meet and even anticipate their needs, is needed to achieve this.

The ability to engage with the insurer using preferred channels, from the customer’s perspective, is considered critically important and creates the necessity for insurance companies to offer digital mobile access, something that is enabled by a cloud-based CRM platform.

Product catalog and policy references

The 2016 U.S. Insurance Shopping Study by J.D. Power found that 74% of insurance consumers use online channels to research their purchase. This tells us that potential insurance buyers want to understand insurance products fully before opting to purchase them.

With product catalog, process workflow guides, and policy references available in CRM systems for insurance agents, barriers between insurance marketing, sales and client support are broken down, and closing deals has become easier.

Based on a case study on the success that can be achieved through insurance CRM software from Salesforce, using integrated sales records, marketing materials and tracking systems for 12 sales offices, Allianz Insurance was able to improve close rates by 17%.

Need help with deciding which CRM is right for your financial institution? Contact our consultants and we will work with you to devise the perfect integration strategy, approach, and plan that will work with your budget and current infrastructure.

Leave a Comment